Introduction to SOX

The Sarbanes-Oxley Act (SOX) of 2002 is a significant piece of legislation aimed at enhancing corporate transparency and accountability in the wake of corporate scandals such as Enron and WorldCom. Named after its sponsors, Senator Paul Sarbanes and Representative Michael Oxley, SOX was enacted to restore investor confidence in the financial markets by imposing strict regulations on publicly traded companies and their auditors.

Detailed Overview of SOX

SOX comprises eleven titles, each addressing different aspects of corporate governance, financial reporting, and auditing practices. The key provisions of SOX include:

- Establishment of Oversight Board: SOX created the Public Company Accounting Oversight Board (PCAOB) to oversee the auditing profession, including the inspection of audit firms and setting auditing standards.

- Corporate Responsibility: It mandates CEOs and CFOs to certify the accuracy of financial statements and imposes penalties for fraudulent financial reporting.

- Enhanced Financial Disclosures: SOX requires companies to provide more detailed and timely financial disclosures, including off-balance sheet transactions and pro forma financial information.

- Internal Controls: Section 404 of SOX mandates management to assess and report on the effectiveness of internal control over financial reporting, aiming to prevent and detect material misstatements.

- Auditor Independence: SOX restricts auditors from providing certain non-audit services to their audit clients to ensure independence and objectivity.

- Whistleblower Protection: It protects employees who report corporate misconduct from retaliation and requires companies to establish procedures for handling whistleblower complaints.

Analysis of Key Features

The core features of SOX address the following key areas:

- Corporate governance and accountability

- Financial reporting and disclosure

- Auditor independence and oversight

- Internal controls and risk management

- Whistleblower protection

Types of SOX

SOX legislation encompasses various types of regulations and requirements, including:

| Type | Description |

|---|---|

| Section 302 | CEO/CFO certification of financial statements |

| Section 404 | Assessment and reporting of internal controls |

| Section 401 | Disclosure of off-balance sheet transactions |

| Section 802 | Criminal penalties for altering documents |

| Section 906 | Criminal penalties for certifying false reports |

Ways to Use SOX

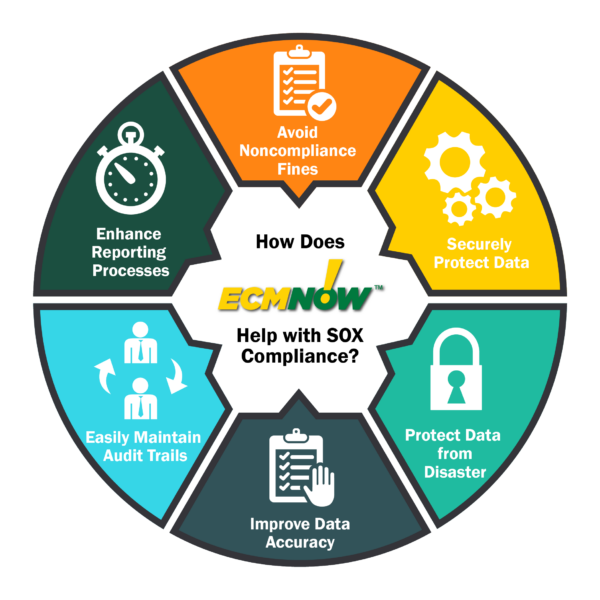

Organizations can leverage SOX compliance in several ways:

- Enhancing corporate governance practices

- Strengthening internal controls and risk management

- Improving financial reporting accuracy and transparency

- Building investor trust and confidence

- Avoiding legal and reputational risks associated with non-compliance

Challenges and Solutions

Common challenges associated with SOX compliance include:

- Compliance costs and resource constraints

- Complex regulatory requirements

- Inadequate technology infrastructure

These challenges can be addressed through:

- Investing in automated compliance solutions

- Implementing robust internal control frameworks

- Conducting regular risk assessments and audits

Characteristics and Comparisons

Comparison of SOX with similar terms:

| Term | Description |

|---|---|

| SOX vs. Dodd-Frank Act | SOX focuses on financial reporting and auditing, while Dodd-Frank addresses broader financial regulatory reforms. |

| SOX vs. GDPR | SOX pertains to financial data and reporting, while GDPR focuses on personal data protection and privacy. |

| SOX vs. Basel III | SOX emphasizes corporate governance and transparency, whereas Basel III focuses on bank capital adequacy and risk management. |

Future Perspectives

Future trends and technologies related to SOX may include:

- Continued emphasis on data analytics and artificial intelligence in auditing processes

- Integration of blockchain technology for enhancing transparency and audit trails

- Evolution of regulatory frameworks to adapt to digital transformations and emerging risks

VPN and SOX

VPN services can be used to enhance the security and privacy of data transmitted during SOX compliance activities, such as:

- Securely accessing and transferring sensitive financial information

- Protecting whistleblower communications and anonymity

- Ensuring secure remote access for auditors and compliance teams

Resources for More Information

For further information on SOX and related topics, refer to the following resources:

- Securities and Exchange Commission (SEC) – Official SOX Guidance: www.sec.gov/spotlight/sarbanes-oxley.htm

- Public Company Accounting Oversight Board (PCAOB) – SOX Regulations: www.pcaobus.org/Standards/Auditing/Pages/SarbanesOxleyAct.aspx

- American Institute of Certified Public Accountants (AICPA) – SOX Compliance Resources: www.aicpa.org/SOX